Card FAQs

This article answers common questions about using, ordering, managing, and paying fees for

physical and virtual cards.

On this page:

General Card FAQs

Will the cards included in my plan be ordered automatically?

Not quite. During your Initial Onboarding Session, your Onboarding Specialist will assist you in ordering the cards included in your plan.

You will be required to provide information such as the details to be written on the cards and where you would like them to be sent.

Are there any other fees outside of the $10 per card?

Yes. Both card types have issuing fees and physical cards incur a postage cost.

Physical cards:

- $10.00 issuing fee

Plus postage:

- $10.00 for Express Post (3-5 business days)

- or $3.00 for Standard Post (8-10 business days)

Virtual cards:

- $5.00 issuing fee

How can I order my cards?

If you have just signed up to Budgetly, your Onboarding Specialist will assist with ordering your initial cards. Book your Onboarding session here if you haven't already.

You can also order cards yourself at any time. See how in our help article here.

Do I pay $10 AUD per card or per user?

Each Budgetly card costs $10 AUD with no additional fees for multiple users on the account. This means that your accountant can access the account for free.

Are Budgetly cards pre-paid or credit?

Our cards are fully functional pre-paid Visa corporate cards.

Do I need a virtual card to pay with my mobile phone?

No. Physical cards can be added to your mobile wallet.

Do the cards have to be issued in someone's name?

In compliance with banking regulations, it is necessary for all cards to be issued under an individual's name.

Can I have a virtual and physical of the same card number?

No. Each virtual and physical card has it's own unique card number.

How soon can I use my card after issuing?

Virtual cards are available immediately in most cases.

Physical cards are posted within 2-3 business days of issuing.

Do all cards require a PIN?

Only physical cards require a PIN.

Although virtual cards do not require a PIN, if you are prompted to enter one during a transaction, please refer to this solution for assistance.

What if I lose my card?

If you misplace your card, please cancel the card as soon as possible.

You or your Admin can then order a replacement card via the app.

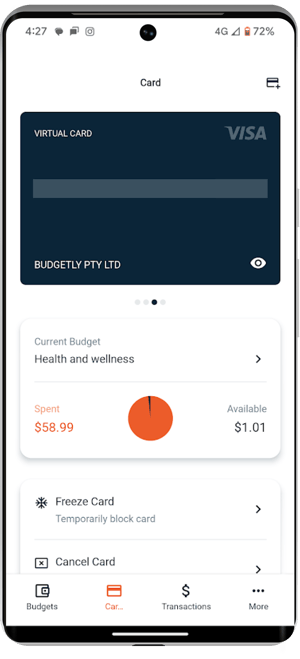

Can I temporarily disable my card?

Absolutely. We allow you to freeze and unfreeze your cards as needed.

Read this article for more information.

Can I have more than one card in my name?

There are no restrictions on the number of virtual and physical cards that an individual can possess, allowing users to have as many cards as they require.

Why is my card showing as requested?

If a card is showing as "requested," it may be because we need additional information from you or your user. Please make sure that all required information, including date of birth and middle name if applicable, has been provided.

If you have already submitted all required information and the card is still in requested status, please submit a ticket or give our friendly support team a call.

I can't complete my purchase because I haven't received my one-time password. What do I do?

Firstly, we recommend checking that the mobile number associated with your Budgetly login is correct. Secondly, check to see if you have received the code via email. Our one-time passwords (OTPs) are sent via SMS, then email as a fallback.

If you have still not received the code after more than one attempt, please submit a ticket or give us a call so we may investigate further for you.

I accidentally cancelled my card. Can I reactivate it?

Once a card is cancelled, it cannot be reactivated or undone. Please be sure to consider this before cancelling your card.

Can I use my card overseas?

Only physical cards can be used overseas.

When you make a transaction in a currency other than AUD, the transaction will be made at the applicable exchange rate + 2.99% fee. It’s standard in the industry.Can a refund go back onto my card even if it’s frozen or cancelled?

Absolutely!

Refunds will be accepted back into your account even if the spending card is frozen or has been cancelled completely.

Physical Cards

Can I withdraw cash with my physical card?

Yes. You have the ability to withdraw cash just like any other bank's debit card.

Check out our help article for more information on Budgetly card withdrawals.

Can I block cash withdrawals on physical cards?

Absolutely. If you are on our Premium plan, withdrawals can be blocked per user.

Withdrawals can also be blocked for all cards on your account by a Budgetly team member. If you wish to look at doing this, please create a ticket.

How do I change my PIN?

You can change your PIN in the mobile app or through Budgetly.io at anytime.

See our article on updating your PIN for step-by-step instructions.

I accidentally ordered my card to the wrong address. Can I update it?

Regrettably, we are unable to update the delivery address for an ordered card. Our cards are sent directly to print once the order is processed. We advise cancelling the card and placing a new order with the correct address to ensure proper delivery.

Virtual Cards

What is a virtual card?

A virtual card a fully functional Visa card, just without the plastic.

They can be added to your mobile wallet and used for contactless payments wherever NFC payments are accepted. Alternatively, they can be kept within the Budgetly app and used solely for online purchases.

Read our full article on the differences between virtual and physical cards here.

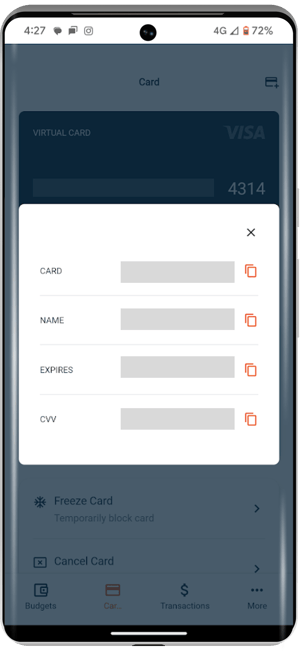

How can I see my virtual card details?

Go to your cards screen and navigate to your virtual card. Click on the eye icon in the bottom right hand corner of the card image to display all card details.

How can I pay with my virtual card using my mobile phone?

You can tap and pay with your virtual card by adding it to your mobile wallet.

How many virtual cards can I have?

The sky is the limit! If you have a few different subscriptions to come from different budgets, you may choose to have one virtual card per budget.

How can I cancel my virtual card?

Our card cancelling article can take you through this process.

I was asked for a PIN when paying with my virtual card. What do I do?

If you are prompted to enter a PIN when using your virtual card, simply press OK and proceed with the transaction. Virtual cards generally do not require a PIN, but if prompted, there is no need to worry.

Still need help? Click here to get in touch with our friendly Support Team.